The Payment Services Directive (PSD) is a payment regulation system that is governed by the European Commission (Directorate General Internal Market) aimed at contributing to the development of a single payment market in the European Union to promote innovation, competition, and efficiency in the EU. The Payment Services Directive bring together payment providers and users in a unified environment that offers consumer protection and right to the users. There are two main sections covered in Payment Services Directive mainly; Market rules and Business conduct.

Market rules dictate the types of organizations that provide payment services, credit institutions (e.g banks), certain authorities (e.g government bodies) or electronic money institutions. Organizations that are not included in the above-mentioned institutions and meet certain capital and risk management requirements can apply for authorization as a payment institution. The Payment Services Directive 2 (PSD2) was proposed in 2013 by the European Commission to improve consumer protection, boost competition, and innovation, introduce new methods of payment and e-commerce. PSD2 took effect on 13 January 2016.

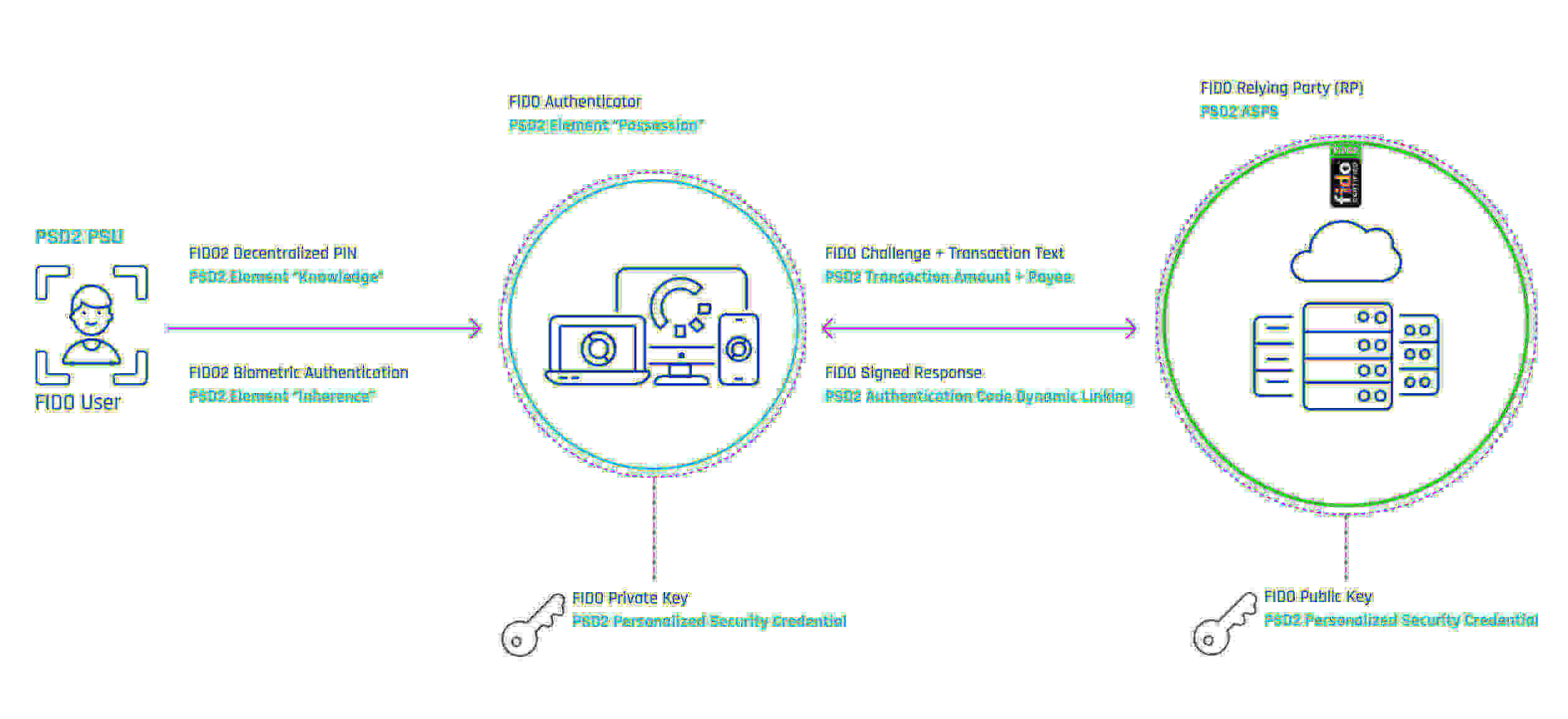

Learn more about Strong Customer Authentication as required by the PSD2.

Example:

"The need for multi-factor authentication for our customers is a hot topic, but our bank's fraud and compliance teams finally agree on something - they both want to deliver PSD-2 Compliant authentication to our customers. "

PSD2 Compliance for Banking Login Demo:

Image: